- Solar advice hub

- Sunsave-announcement

- How you can switch to solar for £0 upfront

How you can switch to solar for £0 upfront

With Sunsave Plus, your savings could exceed your monthly payments – meaning more money in your pocket each year.

Why you can trust our content

We know that the solar industry is full of misinformation, but we only use reliable sources, including:

- Our experienced solar experts, installers and system designers

- Our own database of solar & battery system designs

- Authoritative bodies like MCS and the UK government

At a glance

What's Sunsave Plus and why did we launch it?

We've created Sunsave Plus, the UK’s first solar subscription, because we want to make solar accessible to all UK households.

Here are the three key reasons why Sunsave Plus has come at just the right time for people all over the country:

- High upfront costs

- Lack of maintenance support

- Rising electricity bills

Here's a little more detail on each one.

1) High upfront costs

70% of UK households want to go solar, but so far only 4% have done so. That's an enormous gap, and the main reason is the upfront cost of buying solar panels is prohibitively high for most people. A typical solar & battery system today costs around £10,000, whereas one half of UK households have less than £5,000 in savings, according to the FCA.

Sunsave Plus means you can own a solar & battery system without paying anything upfront, and instead make fixed monthly payments for 20 years. You'll instantly start saving on your energy bills and sell any excess energy to the grid.

In many cases, your energy bill savings could exceed your monthly payments to Sunsave, meaning more money in your pocket.

2) Lack of maintenance support

A 2021 UK government study found that 55% of people who aren't keen on solar were worried about the ongoing maintenance, and more than 40% said a guarantee scheme would allay these concerns – so we made one.

Sunsave Plus comes with the Sunsave Guarantee, which includes 20 years of support including 24/7 monitoring and maintenance, free replacement parts, and downtime cover.

Your system will also be insured by Aviva against damage, fire and theft.

This package is crucial, as industry experts estimate that a solar & battery system will require three maintenance call-outs across a 20-year period – one for the panels, one for the battery, and one for the inverter.

And each call-out can add substantially to the cost – not to mention the hassle of finding a reliable solar engineer to help every time.

3) Rising electricity bills

The electrification of the UK's transport and heating will continue to accelerate over the coming decades, which will raise the price of electricity for homes all over the country.

Electricity is already expensive, mostly due to geopolitical turbulence and our reliance on gas, and energy suppliers have predicted that prices will continue to rise throughout 2025.

It's more worrying than that, though. Energy prices are set to stay high until the late 2030s, according to energy consultancy Cornwall Insight.

This is largely down to the country's shift from fossil fuels to renewable sources, which will lead to our electricity usage growing by 50% between 2020 and 2035, according to the Climate Change Committee.

If the UK doesn't generate enough electricity to meet this increased demand, the price will go up – which seems likely at this point. Solar energy is the perfect solution for many homes.

What's unique about Sunsave Plus?

There's no upfront cost

20-year monitoring & maintenance support

Free replacement battery and inverter

Fixed monthly payments

Insured by Aviva

Savings can exceed payments

The Sunsave Guarantee

Every Sunsave Plus subscription comes with the Sunsave Guarantee – a comprehensive 20-year support and aftercare package that provides you with total peace of mind.

Once installed, you can rest assured that you’ll have a consistent supply of clean, green electricity for the next 20 years. It includes:

- A 30-year performance warranty on your solar panels

- A free battery replacement once it performs at less than 70% of its original capacity – which typically happens after 10-12 years

- A free inverter replacement whenever required (usually after 10-12 years)

- 24/7 monitoring of your system, including alerting you if something isn’t working

- Troubleshooting of any issues and management of any warranty claims

- Insurance – your system is insured by Aviva against damage, fire, and theft

- Downtime protection, meaning we’ll compensate you for any prolonged period that your system isn’t working as it should

To find out more about the Sunsave Guarantee, check out our full guide.

Why you can always rely on the Sunsave Guarantee

In an industry where solar installers regularly come and go, we’ve built the foundations to ensure that Sunsave is around for many years to come:

- We've got serious financial backing from venture capital funds like Norrsken, and the UK government’s Green Home Finance Accelerator

- We're FCA-regulated and fully accredited (and we're also a Which? Trusted Trader)

- We've assembled an experienced, talented team of people who’ve built world-changing products at other companies

- We've got a proven business model. Solar subscriptions already been a success in other countries, including the US, Germany and Spain

But in the very unlikely event that our operating company encounters financial difficulty in the future, the reserves to pay for your system's maintenance would be protected. To learn more, click here.

What are our customers saying about Sunsave Plus?

We strive to deliver superb installations for all of our customers, and we're proud that our work has been recognised by accreditation bodies as well as our own customers.

We've also earned a 4.7-star rating on Trustpilot from more than 120 reviews, some of which you can see below. For more, take a look at our reviews page.

Why is Sunsave Plus better than a loan or a roof lease?

Sunsave Plus is fundamentally better than a roof lease or a loan.

You'll own your system from day one, which means you're free to sell your home or make any home improvements you like, and any export income you earn is all yours.

And our solar subscription is spread across 20 years, which keeps your monthly payments affordable and means you could save more than you spend.

For the entire 20 years, you'll be covered by the Sunsave Guarantee, which comes with 24/7 monitoring and maintenance, free replacement parts, and downtime cover. Your system will also be insured by Aviva against damage, fire and theft.

Here’s a bit more detail.

How is it better than a roof lease?

Unlike a roof lease, we’ve designed Sunsave Plus so that you legally own your system from day one, and it immediately becomes part of the fabric of your property. We don’t need any rights to your roof for any period of time because the system is yours.

This means you’re completely free to sell your home whenever you want, unencumbered – you don’t need to check your contract or ask Sunsave for permission.

You won’t run into any of the issues that mortgage lenders have with roof leases, and you'll have the flexibility to choose what happens when you move home: you can either pass on the agreement to the new homebuyer, or include the value of your system in the price of your property and pay off the subscription early.

And because you own the system, any export income it generates is yours. You're free to choose a tariff and potentially earn hundreds of pounds per year. Check out our article on the best SEG rates, where we've ranked all the export tariffs you can use right now.

The fact that you can earn export income – unlike roof leases, where it's not a given – means your system may be more attractive to incoming homebuyers, and you’ll likely see a greater boost to your property’s value whenever it comes to moving home.

In addition, some solar products that need a roof lease are not regulated by the Financial Conduct Authority (FCA), meaning they don’t have to adhere to high standards set by the FCA when it comes to treating customers fairly.

In contrast, Sunsave is fully authorised and regulated by the FCA, whose Consumer Duty requires us to deliver good outcomes for our customers.

How is it better than a loan?

With Sunsave Plus, while you’re paying back the cost of the system as you would with a loan, you're also benefiting the Sunsave Guarantee.

This support package will ensure your solar & battery system will be protected and keep performing for at least the next 20 years.

It includes 24/7 monitoring and maintenance, free replacement parts, and downtime cover. Your system will also be insured by Aviva, meaning it’ll be fully covered against damage, fire and theft.

Also, spreading your payments across 20 years means households that aren’t able to afford the steep upfront cost of a system can immediately start saving money on their energy bills.

In many cases, your combined energy bill savings and export income can exceed your fixed monthly payment straight away, meaning the loan results in an instant net saving – an immediate, clear return on your investment.

Sunsave, a London-based company, will receive £2 million funding [from the UK government] to ... offer households solar panels for a monthly payment, similar to a mobile phone, rather than an upfront sum.

The Daily Telegraph

18th January 2024

What’s going to happen to UK energy bills?

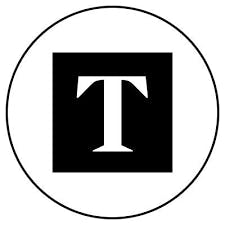

Even before the energy crisis, electricity prices increased by 5.5% each year on average from 2000 onwards.

No-one can fully predict the future, but they are expected to remain high until at least the late 2030s.

With Sunsave Plus, your monthly payments are fixed, so you’re protected against inflation from rising energy bills, and your savings should increase over time.

And after 20 years, once your payments end, your annual savings will increase dramatically.

Sunsave has just struck a partnership deal with Centrica in which its British Gas subsidiary will promote the service to its two million customers on the Hive smart system, which the company anticipates will create a rush of new customers.

The Times

October 2024

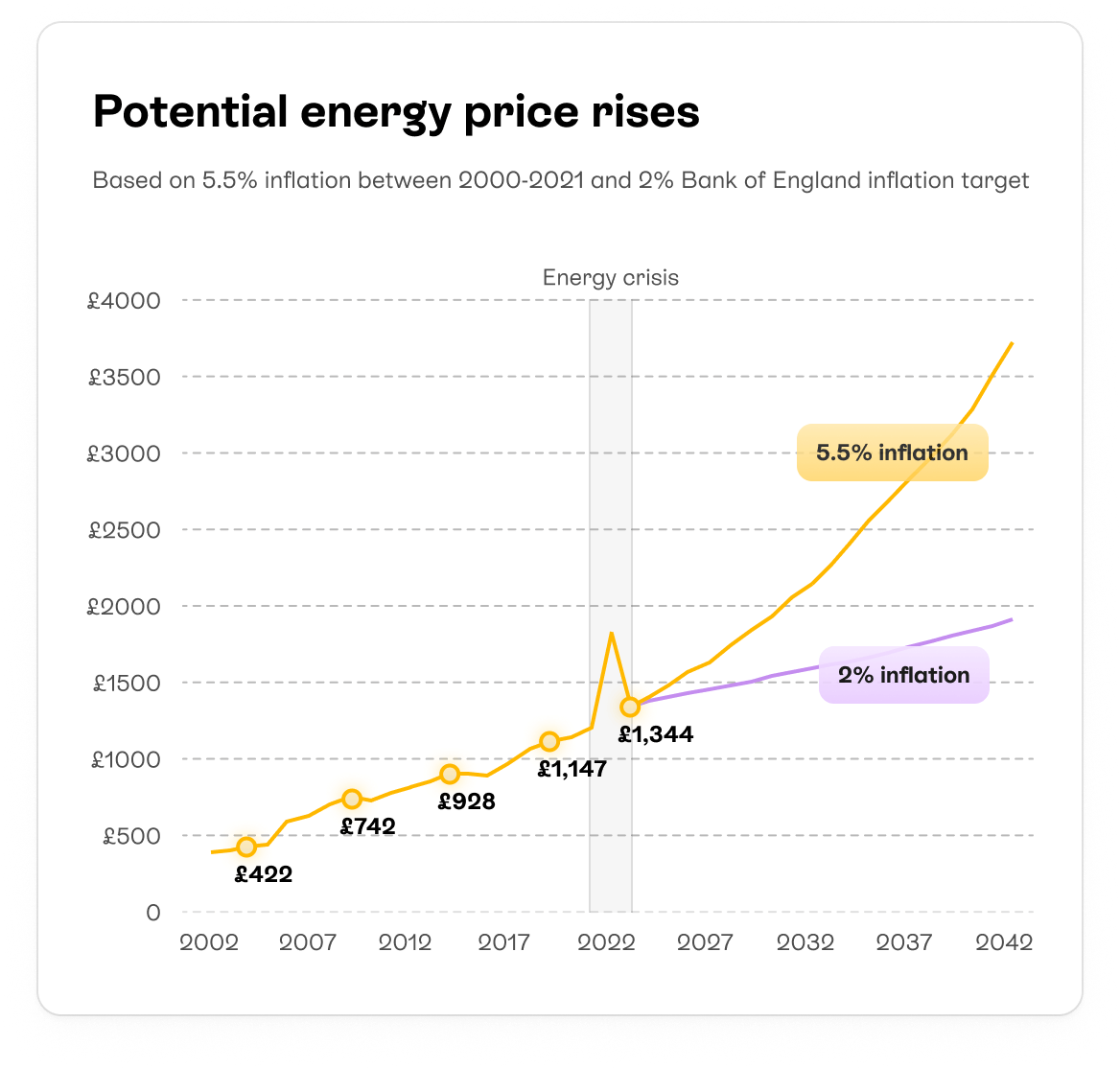

Will Sunsave Plus work all year round?

Solar panels work all through the year, even in the UK. All they need is daylight.

Your solar panels generate the most energy in summer, when you’ll sell the most excess electricity to the grid.

Your solar panel output will drop in winter, but won’t stop completely. You’ll just need to top up with grid electricity.

Next steps

Many people around the world have benefited from solar subscriptions – particularly in Germany, the US, and Spain – and now it's here to unlock solar for UK households.

Solar is a powerful way to save money and reduce your carbon footprint, and there’s no reason people should be excluded due to high upfront costs.

To find out how much you could save with Sunsave Plus, answer a few quick questions below and we'll be in touch.

Sunsave Plus: FAQs

Related articles

Sunsave Plus: a flexible way to go solar

Read full story

Moving home with a Sunsave Plus subscription

Read full story

Sunsave Plus: what if you can afford the upfront cost of solar?

Read full story

Why you can rely on the Sunsave Guarantee

Read full story

Written byJosh Jackman

Josh has written about the rapid rise of home solar for the past six years. His data-driven work has been featured in United Nations and World Health Organisation documents, as well as publications including The Eco Experts, Financial Times, The Independent, The Telegraph, The Times, and The Sun. Josh has also been interviewed as a renewables expert on BBC One’s Rip-Off Britain, ITV1’s Tonight show, and BBC Radio 4 and 5.