- Solar advice hub

- Costs

- Solar panel loans & finance in the UK

Solar panel loans & finance in the UK

Here's how solar panel loans usually work, how they differ from paying for solar upfront, and what the main benefits are.

Why you can trust our content

We know that the solar industry is full of misinformation, but we only use reliable sources, including:

- Our experienced solar experts, installers and system designers

- Our own database of solar & battery system designs

- Authoritative bodies like MCS and the UK government

Calculate savings

What kind of home do you live in?

Calculate savings

What kind of home do you live in?

Solar panel loans: at a glance

Solar panels are an excellent way to cut your electricity costs, your reliance on the grid, and your emissions – but the price tag is a barrier for many households.

Solar panel loans make it possible to save money on your energy bills and shrink your carbon footprint without paying a large upfront cost.

In this article, we’ll run through how solar panel loans usually work and how they differ from paying for solar upfront.

Sunsave Plus, the UK’s first solar subscription, shares some similarities with a loan, but also has some distinct differences.

If you’re interested in switching to solar at no upfront cost, answer a few quick questions below and sign up for Sunsave Plus - we’ll be in touch.

Find out how much you can save

What kind of home do you live in?

What is a solar panel loan?

A solar panel loan is a financial agreement that allows you to own solar panels and benefit from them without having to pay the entire cost of the system upfront.

Instead, you’ll pay a monthly amount for a set number of years. This regular payment, the length of the loan, and the interest rate will all vary depending on your chosen provider.

Some companies also ask customers to pay a portion of the sum upfront, before monthly payments begin.

Solar panel loans represent an alternative route to green energy for households that can’t afford to part with thousands of pounds at a time.

Many solar panel loans also include a solar battery, which makes them more attractive, as they can help homes to save even more on their electricity bills.

How much does a solar panel loan cost?

Before taking out a loan, you should always check the total amount repayable over the term, which consists of the credit amount plus the cost of any interest and fees.

Most solar panel loans come with no upfront cost, though some companies do require households to put down a chunk of the overall amount before they start making monthly payments.

Once this monthly schedule begins, the amount you pay will depend on a few factors, primarily the overall cost of your system, interest rate, and length of your loan.

Short-term loans of one to three years can cost several hundreds of pounds per month, which can still be very expensive for most households.

That’s why we designed Sunsave Plus with a 20-year term. This is the UK’s first solar subscription, and by spreading the cost across 20 years, it could set you back less than £100 per month.*

Every Sunsave Plus system is also protected by the Sunsave Guarantee for the full term, and this includes 24/7 monitoring and maintenance, free replacement parts, downtime cover, and insurance. You can learn more about the Sunsave Guarantee further down the page.

*Figure of ‘less than £100 per month’ is based on multiple Sunsave Plus subscriptions beginning in 2024.

Finance subject to acceptance. Representative example: 240 monthly instalments of £69. 8.9% representative APR. Based on a loan of £7,898 at a fixed interest rate of 5.9% per year. Each instalment consists of £56 loan repayment plus £13 monitoring and maintenance fee. Total amount repayable: £16,560 (includes £5,617 interest and £3,046 monitoring and maintenance fee).

What does APR mean?

When it comes to comparing the cost of different solar panel loans, you should consider the Annual Percentage Rate (APR) as opposed to just the interest rate, as the APR also includes other costs and fees. It shows the amount you’d pay in costs and fees per year, as a percentage of the amount you'd be borrowing. The lower the APR, the cheaper the cost of borrowing.

If you spot a solar panel loan offering a very low APR, it's very important to check whether this rate lasts the full term, or whether it varies throughout the term of the loan.

How long does a solar panel loan last?

Solar panel loans usually range from two or three years to 10 years.

Some providers give you the option of choosing your own repayment period, although this will typically still fall within this range.

Most solar panel loans offer the ability to settle early, but it’s important to check if your provider will charge you a fee for doing this.

Sunsave Plus, the UK’s first solar subscription, has a 20-year term and allows for full or partial early repayment without charging any fees or penalties. Head further down the page to learn more.

Verified expertWe designed our solar subscription, Sunsave Plus, with a 20-year term. By spreading the cost over a longer period of time, it reduces the monthly payment, so many can save more than they pay. And unlike grid electricity, these payments are fixed for the duration.

Robin Mabley

Head of Compliance & Lending at Sunsave

Robin has a decade of experience building regulated products. Prior to Sunsave, he was the Product Director for Global Risk & Compliance at Worldpay.

Who is eligible for a solar panel loan?

Every solar panel loan provider will have a set of eligibility criteria, as they need to control their risk and protect the integrity of the financial system.

To qualify for a solar panel loan, you’ll usually have to be a UK resident and own the property that you’re planning to install the system on. You'll also sometimes have to be in full time employment to be eligible.

You need to be at least 18 years old to apply for a solar panel loan, and most providers also set a maximum age limit for the end of the agreement, which is typically 80-85 years old.

Applicants should also ensure they have a bank account in their name, which they’re permitted to use to independently send payments.

You may also need a mobile phone number and email address, as well as at least one official document, such as your passport, driving licence, or a recent electricity bill in your name.

The lender will then check your application, your borrowing history, your credit, and your financial circumstances before deciding whether to give you a loan.

The UK's first solar subscription

- No upfront cost

- Fixed monthly fee

- 20-year Sunsave Guarantee

The advantages of solar panel loans

There are two key advantages to choosing a solar panel loan:

1) you usually don’t pay anything upfront

2) you free up cash that you would have otherwise spent on solar panels.

Here's a bit more detail.

1. No upfront cost

If you don’t have thousands of pounds that you can spend on a big investment without worrying about it, a loan may be the way forward.

Most loan providers won’t charge an upfront fee, which means you can repay the cost of your panels gradually, over a longer period of time. This can range from a year to upwards of 20 years.

Some households find that this is a more affordable way of paying for solar panels.

2. Free up your cash

Even if you can afford the upfront cost of a solar & battery system, it's important to be aware of your options so that you can make the best decision.

Opting for a solar panel loan with no upfront cost means you free up your cash to be used or invested elsewhere.

For example, you might want to put the money in a high-interest savings account, keep it ready for emergencies, or spend it on a holiday.

To learn more, check out our guide to Sunsave Plus for people who can afford the upfront cost of solar.

The benefits of solar panels

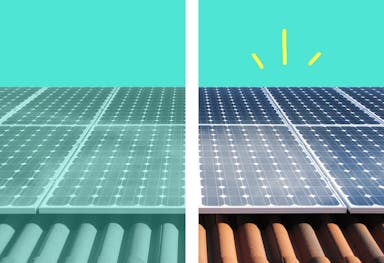

Once the loan has begun and the panels are up on your roof, you’ll be able to start enjoying the three key benefits of switching to solar:

1. Immediate energy bill savings

You can start using the electricity your solar panels produce as soon as they’re switched on, which allows you to cut your electricity bills straight away.

If you wait to buy solar panels until you can afford to pay the full amount all at once, you may miss out on years of the electricity bill savings.

And considering solar panels can last up to 40 years, it might make sense to start benefiting as soon as possible.

2. Export income

Getting solar panels also allows you to profit from exporting your excess electricity to the grid.

Sometimes your panels will generate more electricity than you need – or if you have a battery, more than you can use and store. Energy suppliers will pay for this excess electricity.

The average household can earn £343 per year in solar export income.

This figure is based on a home that uses 3,400kWh of electricity per year (which is the UK average) with solar irradiance of 850kWh per kWp, has a 4.6kWp solar panel system, and a 5.2kWh battery.

The home is signed up to Good Energy's Solar Savings tariff for export, Good Energy EV Charge for import, and exports 65% of its solar electricity.

If you would like to see the savings you could get from a solar & battery system, just answer a few quick questions below and we’ll provide an estimate.

3. Reduced carbon footprint

Solar panels will immediately cut your carbon emissions.

A household with a 5.2kWp solar panel system will typically save 1.1 tonnes of CO2 per year, based on a database of 32 solar & battery systems designed by Sunsave, located across England and Wales. Each systems uses 430W solar panels and a 5.8kWh battery.

This would represent a 31% reduction for the average home, which otherwise has an annual carbon footprint of 3.5 tonnes of CO2.

This figure is based on a government report that households account for 26% of the UK’s carbon footprint , the country’s latest emissions total of 384.2 million tonnes , and the fact that there are 28.2 million households across the nation at the last count.

Find out how much you can save

What kind of home do you live in?

Pitfalls to look out for with solar panel loans

As with any financial agreement, you should only sign a solar panel loan contract if you’re sure it’s the best option for you.

When you’re choosing a solar panel loan, it’s vital that you understand the total cost of borrowing. You need to know how much you’ll be paying overall, including the interest rate and other fees. If the monthly costs turn out to be unaffordable, you will have a very difficult experience and it may have serious repercussions.

Here are the other factors that you should be wary of before committing to a solar panel loan:

- No FCA regulation

- Roof leases

- Inflation-linked fees

- No maintenance support

- Early repayment fees

1. No FCA regulation

When you’re looking into signing a multi-year solar loan contract with a business, you should ensure the company is fully regulated by the Financial Conduct Authority (FCA).

If the organisation is acting as a broker for a third-party lender, make sure you get their FCA number and check the FCA register, as this will show their permissions. You should then also check that the lender is FCA-regulated.

Sunsave is fully authorised and regulated by the FCA, and so our Consumer Duty requires us to deliver good outcomes for our customers.

In practice, what this means is that we sufficiently understand our consumers’ needs, we can demonstrate fair value between the price our consumers pay and the benefits they receive, our content is clear and not misleading, and that our consumers’ needs are fulfilled throughout the lifetime of our product.

2. Roof leases

Solar panel loans sometimes involve customers leasing their roof (or airspace) to a company, which effectively means giving up control of your roof. These are sometimes known as 'rent-a-roof schemes'.

Some roof leases force you to get permission from the company to make changes to your home – like an extension, loft conversion, or new roof – and to reimburse them for any missed export payments or lost electricity generation that happens because of building work.

It can also affect your chances of selling your home. Some mortgage lenders are wary of roof leases, as it may prevent them from repossessing the property in the event of a mortgage default.

You may also find some homebuyers avoid properties with roof leases, especially if they’d ideally like to make changes to the home in future.

The company will own your solar installation, which can sometimes mean missing out on hundreds of pounds in export payments every year.

And given how many people signed solar roof lease contracts in the 2010s, there are still people now who are trapped in these agreements for many years.

It’s also worth noting that some companies that offer roof leases aren’t regulated by the FCA, which means they don’t have to meet the FCA’s high standards when it comes to treating customers fairly.

For more information, read our guide to why Sunsave Plus does not require a roof lease.

Verified expertIt was really important to us that we didn’t create a product that required a roof lease, as there have been numerous problems with homeowners being trapped in unfairly restrictive agreements. In the past, these have complicated processes such as remortgaging and selling your home.

Robin Mabley

Head of Compliance & Lending at Sunsave

Robin has a decade of experience building regulated products. Prior to Sunsave, he was the Product Director for Global Risk & Compliance at Worldpay.

3. Inflation-linked fees

It’s important to make sure that your solar panel loan comes with a fixed interest rate, which means your monthly payments will be the same for the entirety of your contract.

If your loan has a variable interest rate, this makes it harder to plan your budget and can result in you paying considerably more by the end of your loan.

With Sunsave Plus, monthly fees are completely fixed for the full subscription term, which protects you from energy bill inflation.

4. No maintenance support

Like any household appliance, your solar & battery system may run into issues.

Fortunately, there are loan providers that include maintenance in their contracts, to ensure your system is functioning properly throughout the loan period.

But there are also providers that don’t offer maintenance support – so if anything goes wrong, you’ll have to find a reliable, affordable engineer at precisely the most stressful time to do so.

In contrast, when you have maintenance support, you’ll be able to immediately contact someone who you can trust to get your system back to where it should be.

Every Sunsave Plus system is protected by the Sunsave Guarantee for the full term, and this includes 24/7 monitoring and maintenance, free replacement parts, downtime cover, and insurance. You can learn more about the Sunsave Guarantee here, and further down this page.

5. Early repayment fees

If you pay off your loan before the end of your contract, some providers may charge you an early repayment fee.

Fortunately, there are companies that’ll allow you to conclude your contract whenever you want, as long as you pay the remainder of the amount you borrowed.

Just make sure to check any provider’s terms and conditions to find out about its early repayment policy.

If you pay up early with Sunsave Plus, you won’t incur any fees, charges, or penalties.

Verified expertLong-term loans only work if they have the flexibility to cope with anything life might throw at you, and we built Sunsave Plus with this in mind. It can be settled at any time with no fees, or passed on to someone else, e.g. when selling your home.

Robin Mabley

Head of Compliance & Lending at Sunsave

Robin has a decade of experience building regulated products. Prior to Sunsave, he was the Product Director for Global Risk & Compliance at Worldpay.

How is Sunsave Plus different to a standard solar panel loan?

Sunsave Plus is fundamentally different to a standard solar panel loan. Whilst you’re paying back the cost of the system, you also benefit from a full maintenance support package that includes free replacement parts.

And by spreading your payments across 20 years, you can save more than you spend.

Here’s a little more detail.

The Sunsave Guarantee

Your solar & battery system will be protected by the Sunsave Guarantee, so you can rest assured your system will keep performing for at least the next 20 years.

The Sunsave Guarantee will provide you with 24/7 monitoring and maintenance, free replacement parts including a battery and inverter, and downtime cover. Your system will also be insured by Aviva, meaning it’ll be fully covered against damage, fire, and theft.

We know that uneasiness about maintenance can be a key sticking point for anyone who isn’t sure about solar. A 2021 government study found that 55% of people in the UK who don’t want solar panels attribute their reluctance to maintenance concerns.

Some technical experts in the industry estimate that a solar & battery system in the UK will need three maintenance call-outs across a 20-year period - one for the panels, one for the battery, and one for the inverter.

This adds not only cost, but also the inconvenience of finding a reliable engineer to help you every time.

More money in your pocket each month

Sunsave Plus is also an investment in a cash-generating asset – your solar & battery system will immediately start saving you money on your energy bills, and make you additional income from all the electricity you export to the grid.

In many cases, your combined energy bill savings and export income can exceed your fixed monthly payment, meaning the loan actually results in a net saving – an instant, clear return on your investment.

And even if you don’t see net savings in the first year, it’s possible that you’ll start to see them after. Electricity bills rose by 5.5% per year on average between 2000 and 2020 , and this historical trend could well continue. But whilst energy bills rise, your payment to Sunsave will remain absolutely fixed for the full term.

To read all about Sunsave Plus customers who are saving money, check out our reviews page.

Flexible payments

What’s more, Sunsave Plus is flexible, allowing you to make a full or partial early repayment at any point with no penalties. In the case of a partial early repayment, this will reduce your subscription term and keep your monthly fee the same.

Sunsave Plus will show on your credit history as a personal loan. To learn more, check out our FAQs.

It was a transparent process – the cost of the loan, what I would expect to generate in terms of energy to offset my energy bills – the whole process. [...] It was a good exchange of information that helped me make my decision.

Samir

Sunsave customer

Got Sunsave Plus in October 2024

If you want to learn more about Samir's experience with Sunsave Plus, click here to watch the full interview.

Can you get a solar panel loan from the government?

There is currently financial assistance available from the UK government to help households switch to solar, but this is in the form of grants, rather than loans. These grants are:

- the Energy Company Obligation (ECO4) scheme

- the Warm Homes: Local Grant

- the Warm Homes: Social Housing Fund

- the Welsh Government Warm Homes Programme

However, the requirements for these grants are pretty stringent. You can find out if you're likely to qualify by using the eligibility checker on our solar grants page.

Are solar panel loans worth it?

Solar panel loans can benefit households that aren’t able to afford the steep upfront cost of a system. You can instantly start saving on your electricity bills, exporting excess electricity to the grid, and reducing your carbon emissions - all for no (or little) upfront cost.

However, with many solar panel loans your monthly payments could still be unaffordable, and may come with unexpected maintenance costs. That’s where Sunsave Plus comes in.

Our solar subscription is spread across 20 years, which keeps your monthly payments affordable and means you could save more than you spend.

Your system is also protected by the Sunsave Guarantee for the full term, so you’ll have 24/7 monitoring and maintenance support without you having to lift a finger.

To sign up for Sunsave Plus and find out if you’re eligible, enter your details below.

Find out how much you can save

What kind of home do you live in?

Solar panel loans: FAQs

Related articles

Written byJosh Jackman

Josh has written about the rapid rise of home solar for the past six years. His data-driven work has been featured in United Nations and World Health Organisation documents, as well as publications including The Eco Experts, Financial Times, The Independent, The Telegraph, The Times, and The Sun. Josh has also been interviewed as a renewables expert on BBC One’s Rip-Off Britain, ITV1’s Tonight show, and BBC Radio 4 and 5.